NRI GPT

Added on:

Social & Email:

NRI GPT Product Information

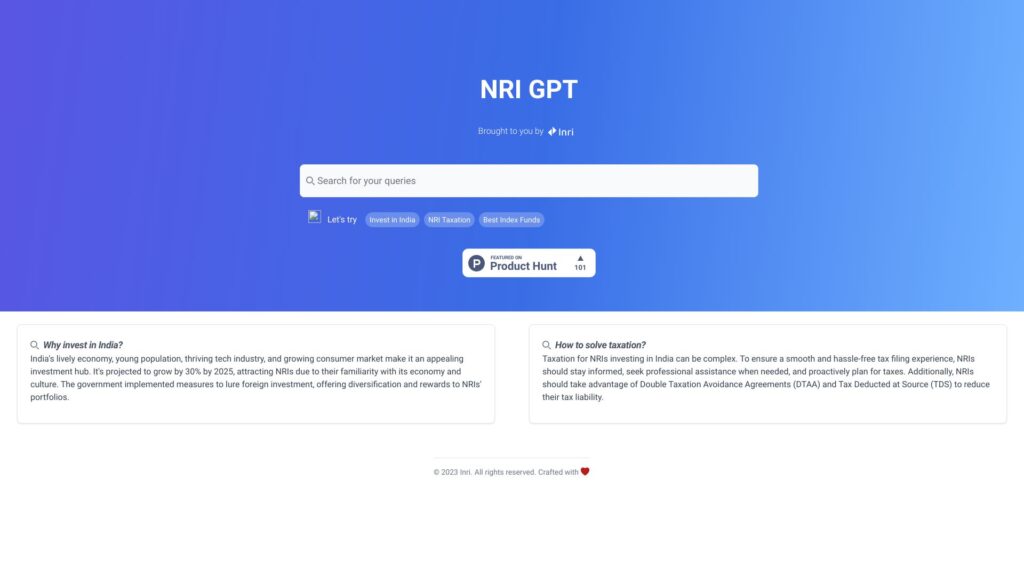

What is NRI GPT?

NRI GPT is a chatbot powered by Open AI ChatGPT that provides answers to queries related to India investing and taxation. It is designed to assist Non-Residential Indians (NRIs) in understanding and navigating the complexities of investing in India and managing their taxes.

How to use NRI GPT?

To use NRI GPT, simply type in your query or question regarding India investing or taxation. The chatbot will generate relevant responses and provide you with information and guidance. You can ask about topics such as best index funds for NRIs, benefits of investing in India, taxation rules, Double Taxation Avoidance Agreements (DTAA), Tax Deducted at Source (TDS), and more.

Why should NRIs invest in India?

NRIs should consider investing in India due to its lively economy, young population, thriving tech industry, and growing consumer market. India is projected to grow by 30% by 2025, offering attractive investment opportunities and potential for diversification.

How can NRIs manage taxation while investing in India?

Managing taxation for NRIs investing in India can be complex. NRIs should stay informed, seek professional assistance when needed, and proactively plan for taxes. They can also utilize Double Taxation Avoidance Agreements (DTAA) and benefit from Tax Deducted at Source (TDS) to reduce their tax liability.

What are the benefits of Double Taxation Avoidance Agreements (DTAA)?

DTAA agreements aim to eliminate double taxation of income for NRIs residing in foreign countries. By availing the benefits of DTAA, NRIs can avoid paying taxes twice on the same income, ensuring a fair and mutually beneficial taxation system.

How does Tax Deducted at Source (TDS) help NRIs?

Tax Deducted at Source (TDS) is a mechanism where tax is deducted from the income at the source itself. NRIs can benefit from TDS as it simplifies tax payment, ensures compliance with Indian tax laws, and reduces the burden of managing tax liabilities.